accumulated earnings tax reasonable business needs

The purpose of accumulated earning tax is to discourage the accumulation of profits if the purpose of such accumulation is to enable shareholders to avoid paying taxes on those profits. A General rule For purposes of this part the term reasonable needs of the business includes 1 the reasonably anticipated needs of the business 2 the section 303 redemption needs of.

How To Structure A Trading Business For Significant Tax Savings

Generally speaking a corporations.

. The accumulated earnings tax is a 20 penalty that is imposed when a corporation retains earnings beyond the reasonable needs of its business ie instead of paying. Tax Court over the imposition of. And profits have been allowed to accumulate beyond the reasonable.

The IRS and corporations can and do find themselves battling in the US. Accumulated Earnings Tax IRC 531 The purpose of the accumulated earnings tax is to prevent a corporation from accumulating its earnings and profits beyond the reasonable. Limit the deduction to the lesser of Step 1 or Step 2 unless subtracting the amount derived in Step 1.

An accumulation of the earnings and profits including the undistributed earnings and profits of prior years is in excess of the reasonable needs of the business if it exceeds the amount that. The tax is assessed at the highest individual tax rate. The accumulated earnings tax which is imposed on corporations for the accumulation of earnings in excess of reasonable business needs does not apply to.

The accumulated earnings tax AET is imposed only on a corporation that for the purpose of avoiding income tax at the shareholder level allows earnings and profits to. Essentially the accumulated earnings tax is a 15 tax on the corporations accumulated taxable income for the tax year. WHAT ARE THE REASONABLE NEEDS OF THE BUSINESS.

The AET is a penalty tax imposed. However this opens the door to the Accumulated Earnings Tax AET if profits accumulate beyond the reasonable needs of the business. The accumulated earnings tax equals 396 percent of accumulated taxable income and is in addition to the regular corporate tax1 Accumulated taxable income is.

Once again the tax can be levied if the IRS identifies that a corporation is withholding dividends and accumulating earnings for reasons other than reasonable needs of. When applicable the accumulated earnings tax is. Group of answer choices.

Multiply the taxable income by the deduction percentage 100000 65 650003. The accumulated earnings tax AET is a penalty tax imposed on corporations for unreasonably accumulating earnings in the corporation. Needs of the business.

Current Developments In S Corporations

Doing Business In The United States Federal Tax Issues Pwc

Quiz 5 Question 1 5 Out Of 5 Points The Sapote Corporation Is A Manufacturing Corporation The Corporation Has Accumulated Earnings Of 450 000 And Course Hero

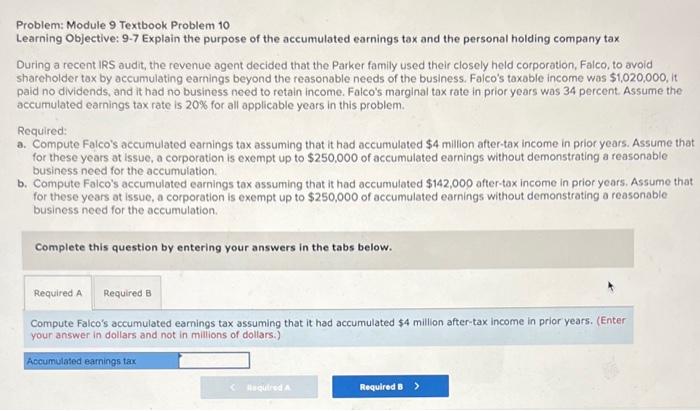

Solved Problem Module 9 Textbook Problem 10 Learning Chegg Com

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Doing Business In The United States Federal Tax Issues Pwc

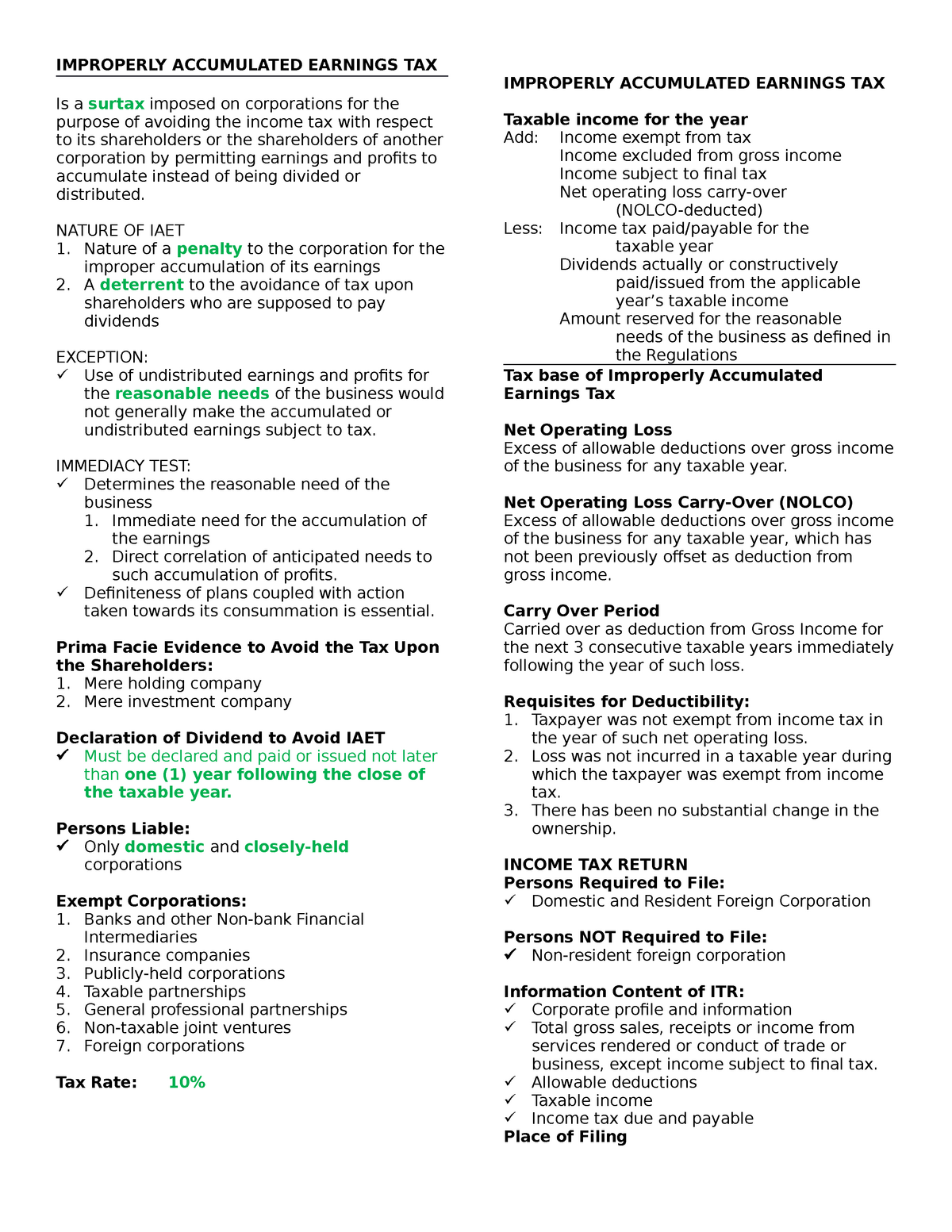

Improperly Accumulated Earnings Tax Improperly Accumulated Earnings Tax Is A Surtax Imposed On Studocu

Is Corporate Income Double Taxed Tax Policy Center

Improperly Accumulated Earnings Tax Improperly Accumulated Earnings Tax Is A Surtax Imposed On Studocu

Fundamentals Of Federal Taxation Key Terms Chapter 17 Key Terms Accumulated Earnings Tax A Studocu

Answered During A Recent Irs Audit The Revenue Bartleby

Qualified Small Business Stock Gets More Attractive

Understanding The Accumulated Earnings Tax Forvis

Determining The Taxability Of S Corporation Distributions Part I

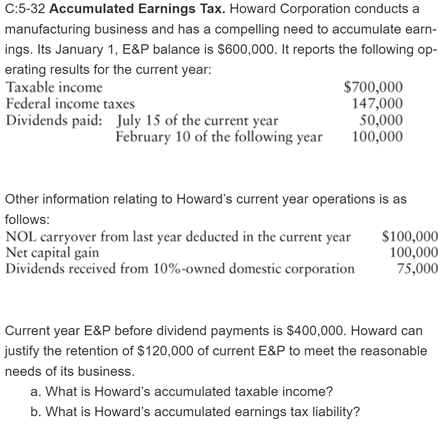

Solved C 5 32 Accumulated Earnings Tax Howard Corporation Chegg Com

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

:max_bytes(150000):strip_icc()/write-off-4186686-FINAL-1-7ada2cf8ad1142a3ae2bf7954bf1a06e.png)