how to lower property taxes in florida

File a Tax Appeal. You must have lived in the same home for at least 25 years.

Florida S State And Local Taxes Rank 48th For Fairness

At least one homeowner must be 65 years of age or older as of January 1st.

. Florida property tax is based on assessed value of the property on January 1 of each year minus any exemptions or other adjustments used to determine the. Property taxes vary from county to county and the average property owner pays about US1700 in property taxes yearly. Nonetheless there are a few ways that may be.

Each county sets its own tax rate. We have attorneys well-versed in the Florida tax system to guide and instruct you on what is the best strategy to lower your property taxes. According to the Leon County Property Appraiser the full exemption allowed tax payers to save up to 818 last year.

A tax appeal is the last resort for homeowners who want to lower their property taxes. For most investment property real estate taxes are the largest single expense item found on the operating statement which in turn dramatically affects the bottom line net profit. Available to all residents and amounting to a maximum of 50000 off the assessed value of the property.

To put 818 into perspective for the typical homeowner. There are also special tax districts such as schools and water management districts that. The average property tax rate in Florida is 083.

At an average home price of 156200 this amounts to. Florida uses a bracket system for collecting sales tax on any taxable sale that is less than a whole dollar amount. The market value of the property must.

Florida is ranked 30th out of 51 including Washington DC when it comes to the highest tax rate in the United States. In calculating the sales tax multiply the whole dollar. At Jurado Farshchian PL.

The most significant potential exemption is the homestead exemption which could save you up to 15 on property taxes if you own your home in Florida and it is your primary. While you wont be able to contest the tax rate you will be able to.

Florida Homestead Check Florida Residential Property Tax Experts

How To Lower Your Property Taxes

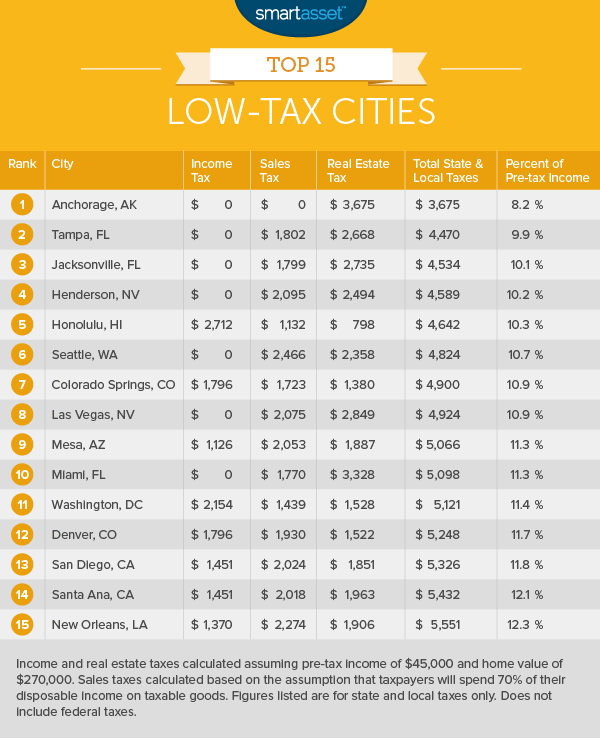

The Lowest Taxes In America Smartasset

Hillsborough County Property Taxes 2022 Ultimate Guide What You Need To Know Rates Search Payments Dates

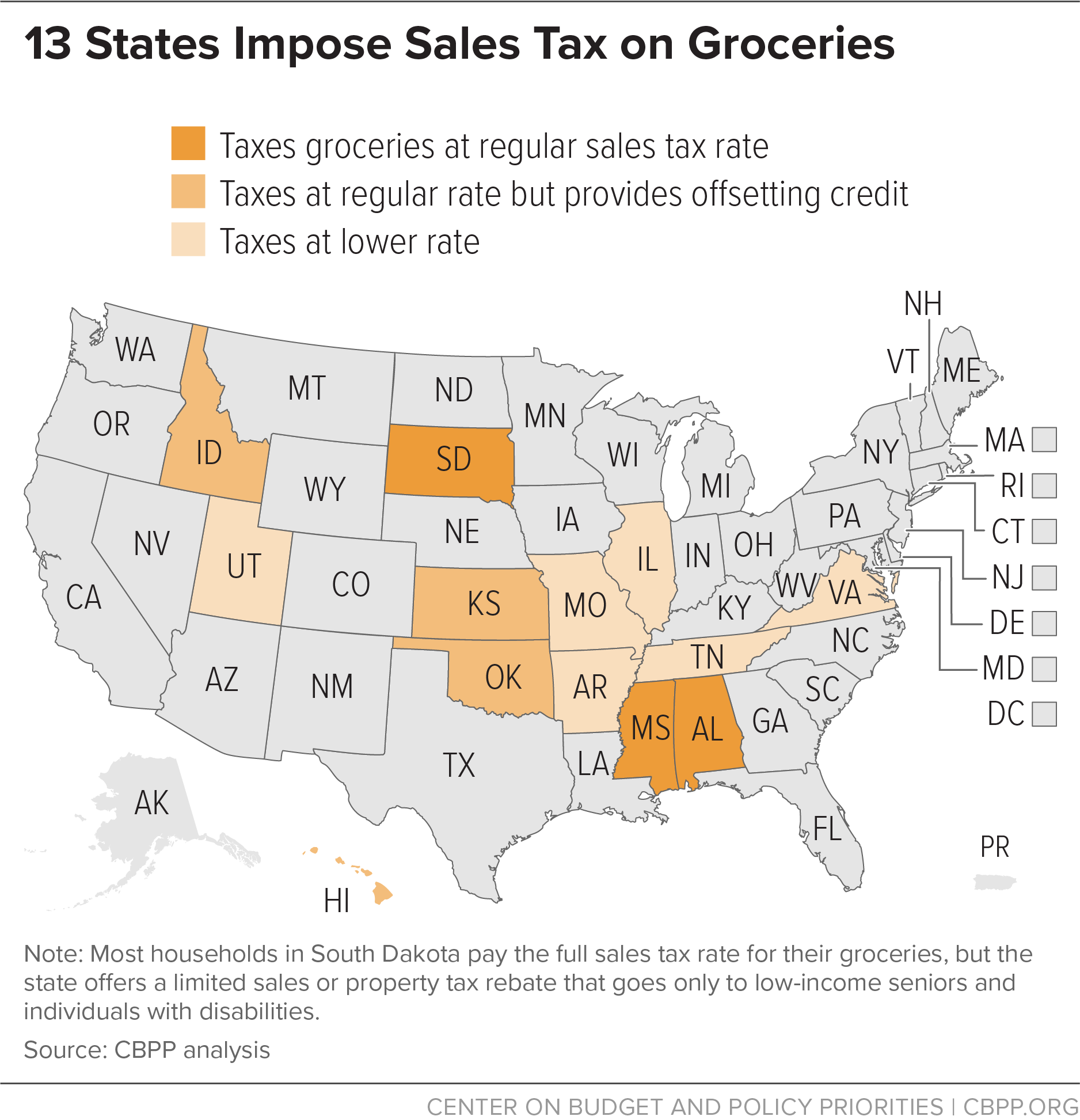

13 States Impose Sales Tax On Groceries Center On Budget And Policy Priorities

Where Are The Lowest Property Taxes In Florida Mansion Global

Florida Bill Seeks To Lower Timeshare Property Taxes Dvcnews Com The Essential Disney Vacation Club Resource

Removing Barriers In Nebraska Part Three How Our Taxes And Spending Compare

How To Lower Your Property Taxes If You Bought A Home In Florida

Florida Property Tax Consulting Firm Property Tax Consulant

Tangible Personal Property State Tangible Personal Property Taxes

How Florida Property Tax Valuation Works Property Tax Adjustments Appeals P A

Historical Florida Tax Policy Information Ballotpedia

Florida Dept Of Revenue Taxpayers

Op Ed Californians Should Wise Up About Our Stupid Tax Code Los Angeles Times

What Will My Property Taxes Be In 2023 In Miami Dade County Miami Herald

Property Tax Calculator Smartasset

Six Ways You Can Legally Avoid At Least Part Of Your Florida Property Tax Bill