tax strategies for high income earners canada

Loaning funds at the prescribed rate of interest to a spouse 1. Max Out Your Retirement Account.

How To Pay Less Tax In Canada 12 Little Known Tips

Change the way you get paid.

. Making a gift to an adult family member. How to Reduce Taxable Income. For the nations highest-income earners those making more than 220000 annually the amount going to the tax man is.

High-income earners make 170050 per year in gross income or 340100 if married or filing jointly. Similar to income splitting this strategy may lower the overall tax obligation for a family and may be suitable for higher income families with liquid assets. Otherwise attribution rules kick in and the funds will be taxed in the hands of the higher-earning spouse.

High income family members with surplus funds. Using the benefits of a registered education savings plan RESP or registered disability savings plan RDSP Investing child tax benefit money in the childs name. In 2021 the employee pre-tax contribution limit for 401 k and 403 b plans is 19500.

For the nations highest-income earners those making more than 220000 annually the amount. Specifically contribute to a traditional 401 k or IRA. The issue of Canadian Tax loopholes has put a target on privately held domestic corporations in Canada and their uses of business tax rates and personal income tax rates.

For high income earners and high-net-worth families taxes can pose a significant impediment to preserving and growing wealth particularly in cases where income or wealth is. The change applies to high-income individuals who make additional contributions to a retirement program during a tax year. Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund.

Ad Helping Businesses Navigate Various International Tax Issues. This is one of the most important tax strategies for you as a high-income earner. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account.

Briefly it involves a higher income family member loaning a lower income member funds at the government prescribed rate of interest. Chen notes that the Income Tax Act in Canada requires that the spouse receiving the funds must keep the funds in the RRSP account for three years. Tax deductions are expenses that can be deducted from your taxable.

Contact a Fidelity Advisor. Learn More at AARP. RRSPs allow you to shelter up to 18 of your gross income per year this maxes out for high income earners who make above 145000 per year The one drawback of the RRSP tax.

Here are 50 tax strategies that can be. The highest rate of 33 per cent. For the sake of this post we consider anybody in the top three tax brackets as a high-income earner.

Ad Build an Effective Tax and Finance Function with a Range of Transformative Services. The math is simple. Discover How EY Assists Businesses by Providing Scalable Tax Services for Their Tax Needs.

We will begin by looking at the tax laws applicable to high-income earners. If you are 50 or older you are eligible to contribute another 6500 as a catch-up contribution. Qualified Charitable Distributions QCD 4.

The math is simple. If properly structured family trusts or partnerships can help you move your investment earnings to family members with lower marginal tax rates. Having the higher income earner pay family expenses.

Income splitting can also apply to pension income. Depending on your province of residence you may be subject to tax at a rate of 50 or higher when your income exceeds 200000. Income splitting and trusts.

Most common is to start a business consulting to other similar businesses who need their skill knowledge or service. This has to generally be done within annual gift exclusions or loans. Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account.

Overview of Tax Rules for High-Income Earners. 6 Tax Strategies for High Net Worth Individuals. The use of these strategies will vary based on personal circumstance.

Lets start with an overview of tax rules for high-income earners. The biggest and best way weve seen highly paid high functioning people reduce their tax is through changing the way they get paid. The concept is much the same although.

This article highlights a non-exhaustive list of tax minimization strategies to consider with your professional advisor. That means that if you earn more than 170050 in. The more money you make the more taxes you pay.

Income Splitting and Trusts. Here are 50 tax strategies that can be employed to reduce taxes for high income earners. These retirement accounts use pre-tax money so you can deduct your contributions from your taxable income.

6 Often Overlooked Tax Breaks You Wouldnt Want to Miss. Here are some of our favorite income tax reduction strategies for high earners. Ad Tax-Smart Investing Can Help You Keep More of What You Earn.

Personal Income Tax Brackets Ontario 2020 Md Tax

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/GYBRY3DQFBBRJAVNF6VR7WBC4U.jpg)

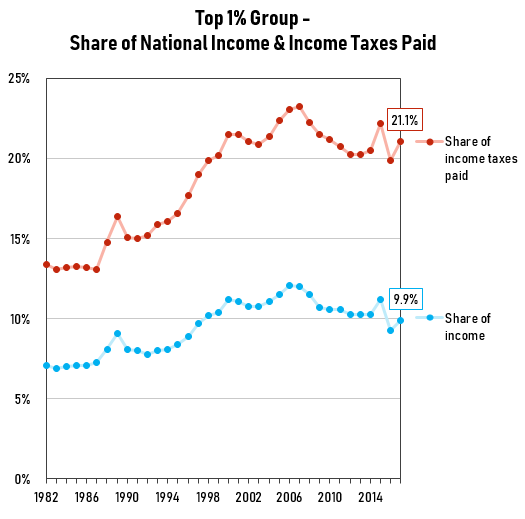

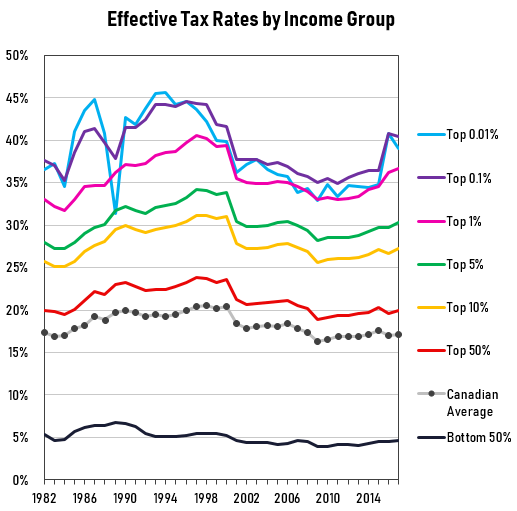

Why The Wealthy Should Anticipate Paying Even More Taxes In The Future The Globe And Mail

Proposed Tax Changes For High Income Individuals Ey Us

Advanced Tax Strategies For High Net Worth Individuals Bnn Bloomberg

Tax Planning Strategies For High Income Canadians

How To Pay Less Tax In Canada 12 Little Known Tips

The Impacts Of Us Tax Reform On Canada S Economy Business Council Of Canada

High Income Earners Need Specialized Advice Investment Executive

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/ZWS5STWVQVE7VJC5G4ZXZXTOIY.jpg)

Why The Wealthy Should Anticipate Paying Even More Taxes In The Future The Globe And Mail

Personal Income Tax Brackets Ontario 2021 Md Tax

Tax Planning For High Income Canadians Accounting Business Consulting And Tax Services Mnp

30 Ways To Pay Less Income Tax In Canada For 2022 Hardbacon

:format(jpeg)/cloudfront-us-east-1.images.arcpublishing.com/tgam/GYBRY3DQFBBRJAVNF6VR7WBC4U.jpg)

Why The Wealthy Should Anticipate Paying Even More Taxes In The Future The Globe And Mail